Pros and Cons of Revshare: Is Revenue Sharing the Right Model for You?

Understanding the Revshare program becomes central when one gets into affiliate marketing. This strategy provides affiliates with a cut of profits, encouraging fruitful collaborations and continued cooperation. It offers enticing opportunities for marketers seeking mutual success due to its potential for high earnings.

A range of pros and downsides should be considered, notwithstanding the overall appeal. Examining your comfort with risk, the product's viability, and the marketing plan will help determine if revenue sharing fits your marketing strategy well. In this in-depth look, we break down the advantages and disadvantages of the Revshare model to help you figure out if it's a good fit for your affiliate marketing journey.

What is Revshare? Understanding How Revenue Sharing Works

In the affiliate marketing strategy known as Revshare, webmasters receive a percentage of the profits they help bring in. This business model involves sharing the money earned by advertisers from customers they refer. This revenue model strategy is preferable to fixed payments because it creates a win-win situation where all parties involved, including the business owners and the clients, gain from each other's success.

RevShare example

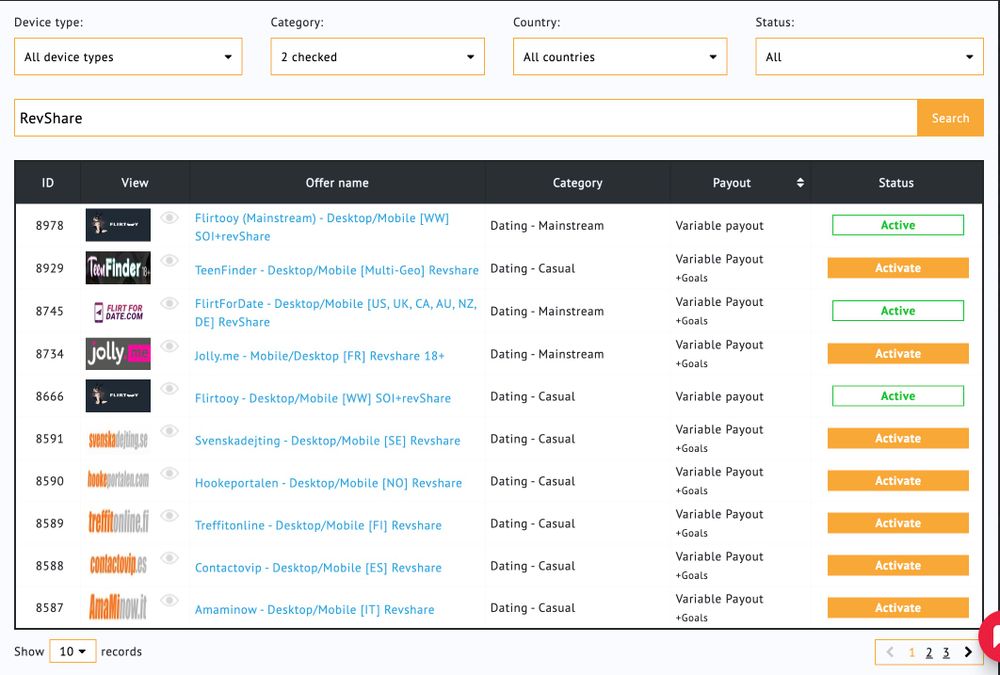

So, let’s discuss how these offers work based on the example from Cpamatica Revshare offers. We have more than 30+ offers in Dating and Games with the Rev-share model for payment (see screen below).

To find more RevShare offers – register to Cpamatica.

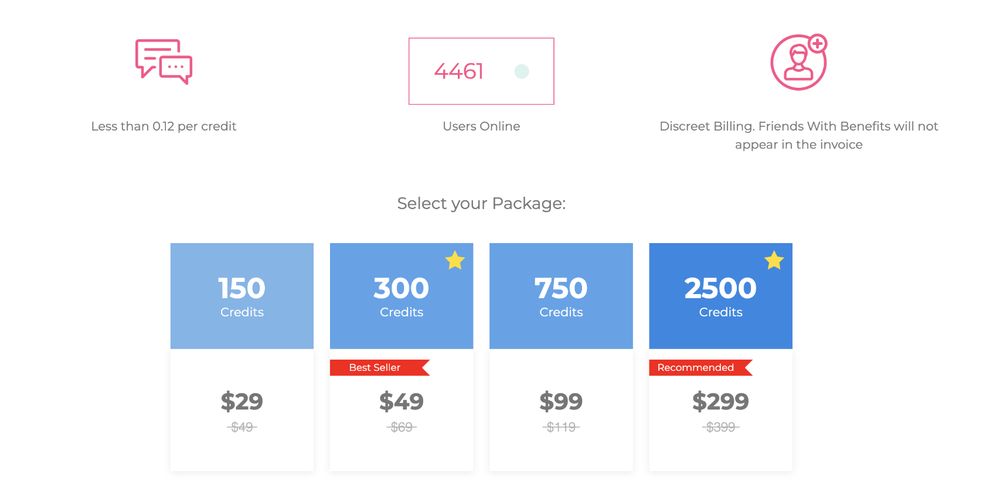

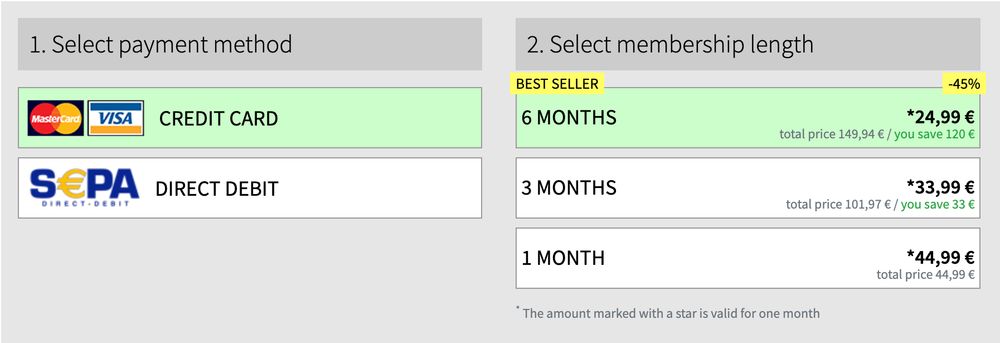

Most of the offers propose Rev Share from 30% to 55% , which means that an advertiser is ready to “share” with the affiliate from 30% to 55% generated from the payment made by the user on the product. Most of those products work on a coin-based monetization system, i.e., a user buys coins/credits (screenshot 2) that he can use for different activities on the product, such as writing messages, hiding profiles, etc. or member packages for different payment periods: 1-month, three-month, and six-month packages (screenshot 3).

Once the user has made the payment on the product, that’s the same time affiliate will receive a fixed % from that payment in your affiliate cabinet. Although, the main point here is that you would receive that same percentage of the revenue from all the charges of the user you have brought to the product during his lifetime. So the better the offer performs long-term, the longer you can receive “dividends” from your traffic.

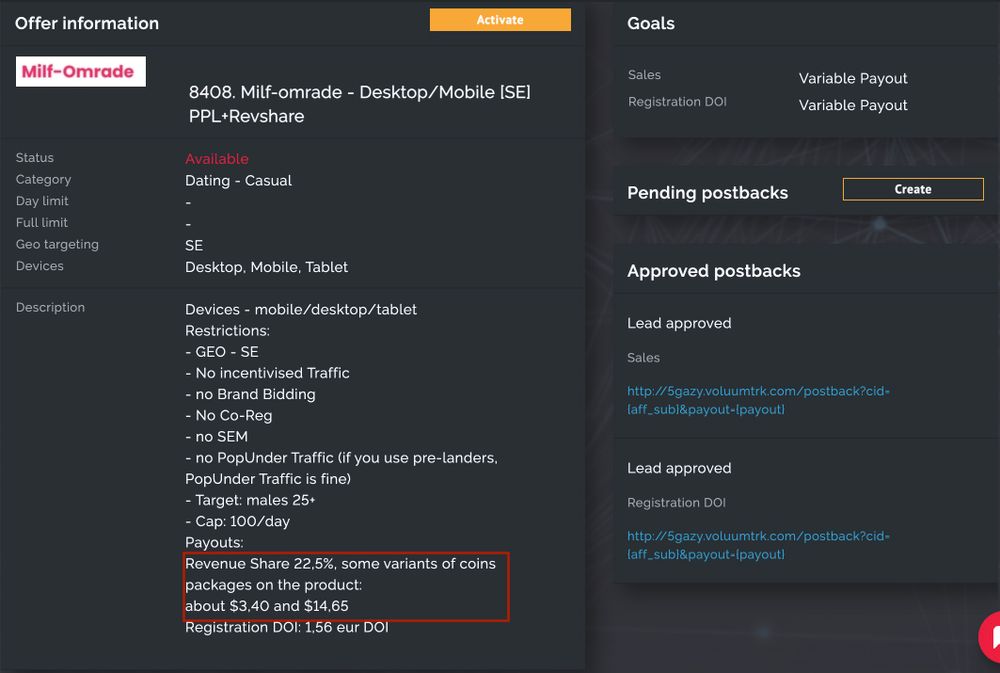

Some of Cpamatica’s advertisers also offer hybrid Rev Share models – PPL combined with Revshare. In these types of offers, affiliates get both CPA (PPL) payout for the SOI/DOI registration with a lower payout than average pure SOI/DOI offer plus Revshare % from the payments made in the product (in the example below, this is 22,5%). In this way, you can benefit from both payment models: a stable income from the CPA model plus long-term dividends from the Revenue Share model.

Factors to Consider Before Choosing Revshare

Affiliate marketers should carefully consider whether the Revshare model suits their needs before committing to it.

- Commission Percentage:

Learn what portion of the total money you may expect to receive from each sale or conversion. To get a decent reward for your work, you need a fair and competitive commission rate. Typical market rates range from 30% to 50%, resulting in a substantial passive income for affiliates over time.

- Conversion Rate:

Examine the advertiser's previous conversion rate (CR) performance. If the product has a high conversion rate, it's probably doing well with its target market and will continue to bring in money.

- Earnings Potential:

Think about how much money you could make based on the selling price of the product, the affiliate payout rate, and your ability to attract users. Pick offers you know will appeal to and sell to your target user base.

- Track Record of Payments:

Verify the affiliate network has a history of paying affiliates on time and accurately. Consistent payment is a cornerstone of any healthy affiliate relationship.

- Analytics and Tracking:

Make sure the retailer has good tracking and analytics options. If you want to know how successful your efforts are and tweak them accordingly, you need accurate tracking.

Advantages of the Revshare Model

The earnings potential is long-term. Find a full rundown of benefits below:

- Lucrative Earning Potential

The Revshare model attracts affiliates with the promise of high profits. Affiliates are more motivated to stretch their creative limits when they see a direct correlation between their efforts and the overall revenue stream.

- Long-Term Partnerships

The appeal of this revenue-sharing model isn't limited to the short-term financial benefits; it also serves as a motivator for building long-term relationships. This affiliate revenue-sharing strategy encourages long-term growth by dividing the profits with the affiliates. They emphasize long-term initiatives that generate steady income rather than short-term wins. In what way?

- Minimal Financial Risk

Revshare is a model that allows for joint profit sharing and risk distribution. It's a model that helps new affiliates by eliminating costs in the beginning and reducing potential losses. This attracts marketers with limited resources who are entering the affiliate marketing industry.

- Motivation for Quality Traffic

The model's structure compels affiliates to give top priority to high-quality traffic. As their income depends on how many people become paying customers, they are incentivized to find people who are truly curious about what they offer. With both goals so closely aligned, affiliates are more likely to drive conversion traffic. To learn more about maximizing click-through rates, read our expert's guide on Affiliate Marketing for the Dating Niche .

Disadvantages of Revshare Model

Although there are many benefits to using Revshare, it is essential to remember that there may also be some negatives. Let's examine the drawbacks that need to be weighed carefully:

- Uncertain Earnings

The Revshare model offers a potentially lucrative opportunity but comes with a degree of risk. Changes in the market and traffic volatility might cause earnings to fluctuate in unexpected ways. Partners need to have financial safety nets to weather periods of inconsistency.

- Dependence on Advertiser Performance

Even if an affiliate is excellent at generating clicks, sales won't improve if the product price or service the affiliate offers is lacking. Due to the interplay of these factors, affiliates have little say over what determines their income and percentage of revenue sharing.

- Initial Effort vs. Payout Time

This model may seem appealing due to the potential for significant gains, but it is essential to remember that not all efforts immediately pay off. Affiliates may need to put in much work and money before seeing significant revenue. Attracting visitors and turning them into paying customers is a process that might take time and effort.

- Risk of Revenue Attribution Issues

In this age of multi-touch customer journeys, it might not be easy to attribute total amount of revenue generated to individual affiliates correctly. Affiliate's and advertiser's relationships can be strained if they disagree on how much credit each party should get for a sale. This problem will not arise if you work through an affiliate network rather than directly with the advertiser. In Cpamatica , our affiliate managers are always eager to get the best rates for affiliates.

Comparison with Other Affiliate Models

The affiliate program's Revshare model must be compared to other prominent models, such as CPA (Cost Per Action) and CPC (Cost Per Click), to determine its viability. Since every model has its advantages and disadvantages, marketers must pick the one that works best for them.

Revshare vs. CPA (Cost Per Action)

Revshare is unique among revenue sharing platforms because it gives affiliates a cut of the real money made. In contrast, cost-per-action (CPA) models pay affiliates based on predetermined metrics like clicks, leads, and sales. While CPA can help you budget your money, It can boost your income if your conversion rates are exceptionally high.

One disadvantage compared to CPA payouts is the lack of assurance surrounding income generation. Affiliates looking for more stability in their income could prefer the CPA model, while those more interested in earning potential and fostering long-term partnerships might prefer this platform.

Revshare vs. CPC (Cost Per Click)

Affiliates in the CPC model receive payment for each click they drive, regardless of whether or not that click results in a sale. Yet, with Revshare, affiliates are only paid when they generate money, not for clicks.

Although cost-per-click (CPC) models are simple to implement, they may not be compatible with the revenue-sharing objectives of affiliates. Those that put a premium on bringing in new business will find that it offers some excellent financial rewards.

Is Revenue Sharing the Right Model for You?

Your performance-based objectives, available resources, and willingness to take risks should all be considered when settling on an affiliate marketing scheme. If you're looking for significant earnings potential from a product or service, lasting business relationships, and creative leeway, it is the way to go.

Conclusion

If you're an affiliate program owner, Revshare stands out as an appealing option due to its promise of considerable profits and long-lasting partnerships. Affiliates that adopt this strategy must assess the benefits against the risks and difficulties that may arise. Whether or not Revshare is the ideal fit depends on the chosen strategic strategy that aligns with your particular goals.

Recommended Articles

AI Dating: unlocking revenue from young users

Affiliate Marketing Glossary